Calling all those who experience feelings of intimidation, confusion, shame, anxiety and paralysis pertaining to their Personal Money Matters!

We all struggle with money. We struggle especially with our emotions and behaviors pertaining to our money no matter how much or how little money we have. We experience negative emotions related to our decisions and behaviors surrounding our money. Did you know that all of our financial decisions are driven by our emotions. Most commonly we feel shame, anxiety, and fear as a result of our money decisions or due to external circumstances impacting our feelings about our money, as well as, our feelings of financial security. Our society perpetuates a scarcity culture that drives our feeling of never having enough. By shining a compassionate light on our own Money Story, we gain the clarity to focus on what matters in our lives, what is important, and what will bring us peace and joy.

– Susannah Kavanaugh

My clients gain hope that their knowledge, behaviors and success with money can be different. They gain the insight into and an understanding of why they experience challenging emotions surrounding their money matters. They gain the skills and habits to engage with their money with self-compassion, curiosity, and a desire to have a respectful and prosperous relationship with money.

“When we speak the truth about money, deep healing happens. Taboos are broken, veils lift, and radiance breaks forth.”

“When we speak the truth about money, deep healing happens. Taboos are broken, veils lift, and radiance breaks forth.”

Bari Tessler

Client Experience

A client presented with a significant amount of debt relative to her assets and savings. She is a single mother, grandmother, caterer and community advocate. Her concerns about her financial security continued to plague her in the middle of the night impacting her quality of sleep. She was concerned that she would have to work until the day her body meets its expiration date. During our work together, she focused on her true values; her children, grandchildren, and her catering business. She was diligent outside of sessions completing homework assignments and preparing for our work together by analyzing the potential changes she was able to implement and how she would implement those changes.. She quickly identified methods to reduce her debt in addition to ideas on how to reallocate her savings in a way that would allow her net worth to accumulate faster. She identified exactly how she intended to spend her disposable income by celebrating her grandchildren individually with a creative and empowering approach that strengthened her bonds with her grandchildren. This intense focus on her goals inspired her to reach her goals to increase her savings faster. And as her financial therapist, I was inspired by her devotion to her family. She continues to check in quarterly and her sense of self-pride and money competence is humbling.

Meet Susannah

Susannah’s family and career experiences indicated that money can cause internal feelings of ineptitude, emotional distress, and shame. She observed conflict in relationships as individuals judged and blamed one another when money obscured the issues at hand. So, she pursued the skills and knowledge of how one might enjoy peace and harmony with money. Susannah is honored to look with curiosity at her clients’ money stories and to reframe their perceptions to empower themselves and to experience a life with joy, pride, and self-worth.

Susannah is a Licensed Clinical Professional Counselor (MT) with Certifications in Intensive Family Therapy and Gestalt Therapy. After earning her MBA, she worked in the financial services industry as an analyst in banking, biotechnology, and venture capital. She is a Certified Money Coach through the Money Coaching Institute with Deborah Price. She has certificates in Wealthy Family Advising and Family Business Advising through the Family Firm Institute of Boston. She is a candidate for the Accredited Financial Counselor Certification. And, she is a participant in Bari Tessler’s Art of Money Mentorship Program for financial coaches. Susannah is not trained as a Financial Planner or a Financial Advisor.

“Susannah provided me with such an incredible experience as my money coach. She is armed with fantastic tools and was very easy to work with. I had several “Aha” moments while we dug into my past money memories. The 4 sessions doing the core process were invaluable and have allowed me to open my eyes to my beliefs and values – what works and what doesn’t. I couldn’t recommend her enough.

Thank you Susannah for being such a wonderful money coach.”

J.V.

“Through Susannah’s innate ability to expand my understanding of who I know myself to be, to encourage me to refocus on what is vital, to challenge me to grow, and to remind me that I am perfect in my imperfections, I have come home to myself.”

A.W.

Susannah is an amazing financial coach and money therapist! I highly recommend her for your personal and business money coaching. She helps you understand your money story from childhood and work past that to financial success!

B.

Susannah’s approach to uncovering misaligned beliefs about money is brilliant. She creates a safe space where vulnerability is welcomed, encouraged, and celebrated. Through soul searching questions, laughter and a lot of “lightbulb” moments, Susannah helped me realize the discomfort I felt discussing money and money management was not necessarily mine. It was a learned behavior that started during childhood. I now have a healthier view of money and an exciting new role that money plays in my life. It’s never too late to learn!!

T.S.

Services

Resources

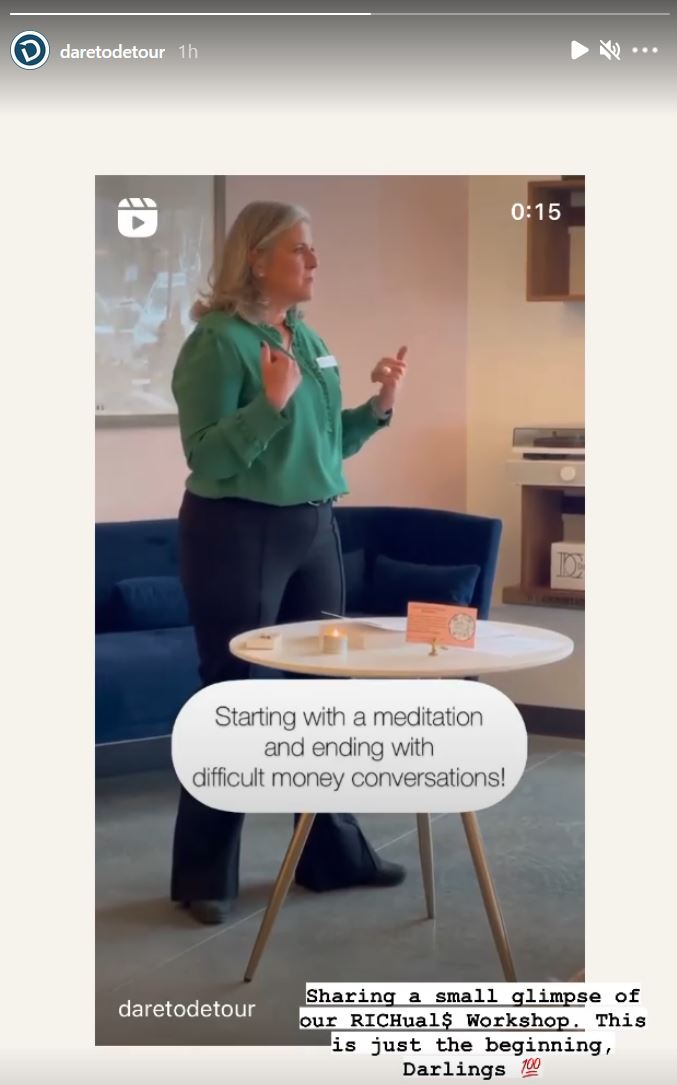

RICHual$: Honoring Your Worth

What a wonderful opportunity to engage in a conversation about [...]

“Core Values And Financial Wellness” – Forbes Article

Once you identify, clarify and prioritize your values, goals become [...]

Susannah’s Financial Resource List

Budgeting Apps Clarity Money App Free Personal [...]